Keeping it Regular: COSS Co-Founder Rune Evensen on why regulation is good for crypto price movements

COSS co-founder Rune Evensen on how regulation can benefit the crypto market and shares ideas to promote a wider adoption of cryptocurrencies.

As the operator of cryptocurrency exchange COSS, Rune Evensen is a serial entrepreneur who has witnessed the many meteoric rises and precipitously bottoming out of virtual currencies and tokens prices over the last few years. It’s a cyclical roller-coaster ride and most recent one moon-like spikes took place at the end of 2017 that preceded a wave of panic selling soon after. This has largely been attributed to reports of a complete ban on cryptocurrencies in some countries and bearish proclamations from institutional investors.

The Norway-born business and start-ups consultant is unfazed and believes that the “bear is about to grow some horns and put on its bull mask”. He doesn’t attribute this to wishful thinking. But rather a belief in the underlying fundamentals of the technology and an understanding that eventual compliance and regulatory frameworks will allow the collective crypto community to flourish.

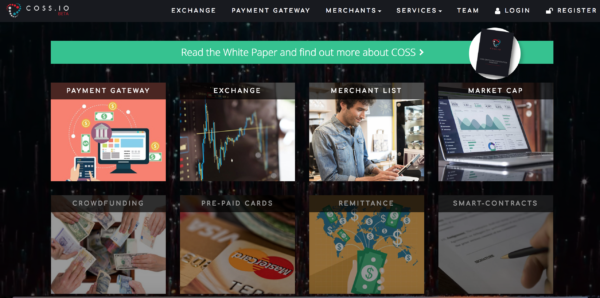

COSS.io has undergone a site revamp earlier this year. How have users responded to these changes?

A new user interface has been delivered and a full update for the remaining pages will soon be pushed live. Users are in general very happy with the changes, and despite the bear market, we have seen an increase in trading volume. We are still a low liquidity exchange that focuses on organic growth. Currently, in April, daily trading volume hovers around US$7 million.

You have been actively engaging with Singapore’s monetary authorities (MAS) about the future of cryptocurrencies exchanges and the need for progressive regulations. What has been the conclusions so far?

Yes, we have been active in the feedback process of the MAS consultation paper about a proposed new payment bill. To our understanding once, and if, it passes parliament legislation it will be enacted and come into play six months later. Likely, an additional six-month grace period will be given to companies to comply with the licensing structure to operate under the new regulations.

We aim to be ready with our application and I’m eager to see the final version from MAS to see what proportion of our feedback is taken into consideration. We are looking forward to a more regulated crypto space in Singapore, both to protect the industry and the end-consumers. As a result, I’m hopeful that the banks will also adopt a more positive stance towards companies dealing with cryptocurrencies.

There are over 10,000 exchanges listed on CoinMarketCap. What do you think is going to happen within the next year?

The industry is still in its infancy and there will be more players entering the market. The number of exchanges operating today will change over time. I assume some form of consolidation will happen as regulations kick in. There could be mergers and alliances formed between exchanges to cover more ground in terms of local presence and fulfilling licensing requirements.

I am not worried about the number of exchanges. Nevertheless, I am worried to an extent that many of them are not fully focused on current and upcoming regulations.

We need to stay compliant and work closely with the regulators to stand any chance of reaching mass adoption.

Will Japan’s positive outlook on cryptocurrencies and ICOs influence other Asian countries to adopt a supportive stance?

Japan took the high road by declaring that crypto is currency. Most other countries are looking into very specific regulations when it comes to cryptocurrencies. I think both China and Korea will also implement regulatory changes. Temporary bans can be an effective tool to clean up the market. I still prefer the Singapore way where they allow the industry to grow and prosper while working on regulations. To implement a complete ban will basically kill the market while regulations are pending. It is not very in line with the entrepreneurial spirit championed.

What would be your three key ideas to promote a wider adoption of cryptocurrencies among the general public?

We need to work with the regulators to ensure that both the industry and the end-consumer get some form of protection. That is a key element. Of course, the ease of entering the market must see some changes. Quick buy options without a complicated process will also attract more individuals.

A direct relationship and link between banks and exchanges is also a crucial step. Human nature is to avoid hurdles, so we need to remove as many hurdles as we can.

If a newcomer can load an exchange with Fiat currency directly from his bank account to an exchange and then click a quick-buy option would be the perfect scenario. The should also be more proven use-cases and we need to reach a stage where spending crypto makes sense because today, it doesn’t. It is still very much a speculative asset and a store of value to some. And not a currency that people prefer to use daily.

What has three-month price surge of Bitcoin (Nov 2017 – Jan 2018) taught you?

November to January were crazy months where we saw all-time highs for many virtual coins and tokens. The experienced players in the market knew that January and February normally correct the market downwards as it has done so previously. Many of the newer players did not know this and maybe they thought the bull run would continue forever. Nothing ever does. What goes up must come down. Over time it is possible to have a strong upward trend. To see people borrowing money to get in is crazy. It is possible that they are now sitting on 30% of the collateral due to over-extended bear run in the market. My tip is to stay calm, don’t panic and to only invest what you can afford to lose.

Is there anyone in the crypto scene who has inspired you?

I like to highlight the work Anson Zeall does for the Singapore community, but there are also many old and new players that are stepping up to the plate in a positive way. So instead of highlighting any specifics, I will say that my drive to soldier on comes from my three lovely, wonderful and supportive children.

The upcoming COSS summer party to be held in Singapore on June 9th. You can find more details about it here.